If you’re like me, then this is probably not the first time you’ve ever heard of rent-to-own as an alternative to more traditional methods of home purchase. Rent-to-own is frequently advertised as an option for those folks who are precluded from buying a home because of credit issues or the inability to come up with the cash for a down-payment.

The more traditional model of home purchase goes something like this:

-

The sale takes place shortly after the offer has been accepted.

-

Since most buyers don’t have the money to pay cash, a mortgage is usually used to finance the purchase. To qualify for a mortgage, however, potential buyers need to have a good credit score and cash for a down payment. Without the cash to make a down payment or a good credit score, purchasing a home in the traditional way may not be an option.

A rent-to-own agreement is an alternative to the traditional model that could provide individuals who are unable to otherwise purchase a home the opportunity to do so.

A rent-to-own agreement is commonly viewed as having two components to it:

-

A lease agreement component

-

An option to purchase component

As noted by NOLO.com, rent-to-own agreements are lease agreements that also give the tenant an option to purchase the rental property, usually a single-family house, sometime after the beginning of the tenancy. The title to the house remains with the landlord until the tenant exercises his or her option and purchases the property. In other words, tenancy is the starting point of this kind of an arrangement, not a purchase transaction.

As usual, the devil is in the details of any agreement, and the rent-to-own agreement is no exception.

Key Lease Agreement Terms

The following are some of the recommended terms, as listed by NOLO.com, to be included within the lease agreement component:

-

Signed by all tenants. This makes each tenant legally responsible for all terms, including the full amount of the rent and the proper use of the property.

-

Limits on occupancy. This gives you grounds to evict a tenant who moves in a friend or relative, or sublets the unit, without your permission.

-

Term of the tenancy. Should state whether it is a month-to-month rental agreement or a fixed-term lease.

-

Rent. Specify the amount of rent, when it is due, and how it's to be paid.

-

Deposits and fees. To avoid confusion and legal hassles, your lease or rental agreement should be clear on the limit, use and return of deposits.

-

Repairs and maintenance. Set out your and the tenant's responsibilities for repair and maintenance in your lease or rental agreement.

-

Entry to rental property. Your lease or rental agreement should clarify your legal right of access to the property -- for example, to make repairs.

-

Restrictions on tenant illegal activity. Limit your exposure to lawsuits from residents and neighbors, by including an explicit clause prohibiting disruptive behavior, such as excessive noise, and illegal activity, such as drug dealing.

-

Pets. Be sure your lease or rental agreement is clear on the subject. Identify any special restrictions.

-

Other Restrictions. Be sure your lease or rental agreement complies with all relevant laws including rent control ordinances, health and safety codes, occupancy rules, and antidiscrimination laws.

Key Option Agreement Terms

The following are some of the essential recommended terms to be included within the option agreement component of the rent to own agreement. An option to purchase must:

-

State the Option Fee.

In order to be contractually enforceable, the option to purchase must be given in exchange for value. Depending on factors such as the price of the home, the option fee can range from several hundreds to several thousands of dollars. Option fees are typically nonrefundable. In other words, if the tenant decides not to exercise his or her option to purchase the house within the agreed-upon time frame, the tenant forfeits the option money.

-

Set the Duration of the Option Period.

An option-to-purchase contract must conspicuously state the duration of the option period. Option periods can range from months to years.

-

Outline the Price For Which the Tenant Will Purchase the Property in the Future.

As long as both parties are in agreement as to how the value of the house is to be determined, the option contract is enforceable.

-

Comply with Local and State Laws.

Some state laws specifically protect tenants from entering contracts they do not understand. Check with your state department of real estate to find any applicable laws that may apply to your option to purchase contract.

In conclusion, a rent-to-own agreement gives potential buyers the ability to move into a house as they get back on their feet financially until they’re able to buy the home later. However, it can be risky since the potential buyers could lose money if they fail to buy the property when its lease expires.

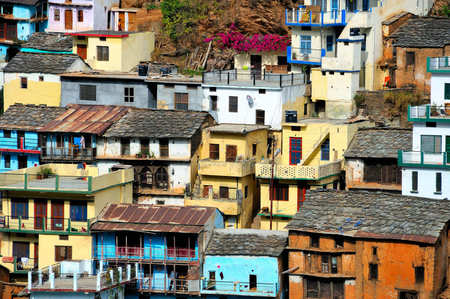

Image courtesy of Ralf Kayser @ Flickr